Western Union Exchange Rate Your Dollar To Inr Guide

Lead: Navigating international money transfers requires careful attention to exchange rates, especially for individuals in the U.S. sending funds to India. This comprehensive guide delves into the specifics of the Western Union exchange rate for U.S. dollars to Indian Rupees (USD to INR), offering essential insights into how these transfers work, what factors influence the rates, and how users can optimize their remittances. Understanding the nuances of the Western Union exchange rate your dollar to INR guide is crucial for making informed financial decisions and ensuring recipients receive the maximum possible value.

What Is the Western Union Exchange Rate Your Dollar to INR Guide?

The "Western Union exchange rate your dollar to INR guide" refers to a detailed understanding of how Western Union, a global leader in cross-border money transfers, facilitates the conversion of U.S. dollars into Indian Rupees for remittances. It encompasses more than just a numerical rate; it's a framework for grasping the entire process, from initial inquiry to final payout. This guide explains:

- Western Union's Service: How the company provides a platform for sending money internationally, offering various methods for both sending and receiving.

- Exchange Rate Mechanics: The specific rate at which one USD is converted into INR at any given moment, and how this rate is determined by market forces and Western Union's own pricing.

- Transfer Process: The practical steps involved for a U.S. sender to initiate a transfer and for a recipient in India to collect the funds.

Essentially, its a manual for U.S. consumers to effectively utilize Western Union for transfers to India, focusing on the critical aspect of currency conversion.

Why the Western Union Exchange Rate Your Dollar to INR Guide Is Trending

Interest in the Western Union exchange rate your dollar to INR guide is consistently high due to several significant factors. The large and active Indian diaspora in the United States frequently sends money home, making the U.S. to India corridor one of the busiest for remittances globally. As a result, individuals are continuously seeking the most efficient and cost-effective ways to transfer funds. Key reasons for its prominence include:

- Remittance Volume: India remains the world's top recipient of remittances, with a substantial portion originating from the U.S.

- Economic Impact: These transfers play a vital role in supporting families and contributing to the Indian economy, driving a constant need for reliable services.

- Rate Fluctuations: Currency exchange rates are dynamic. Senders frequently monitor rates to capitalize on favorable movements, making a comprehensive guide invaluable.

- Digital Convenience: The increasing shift to online and mobile transfers makes understanding digital platforms like Western Union's more critical than ever.

The ongoing economic connection between the two countries ensures that optimizing the USD to INR exchange through reputable channels like Western Union remains a persistent focus.

Dates, Locations, or Key Details

While not an event with fixed dates or locations, the concept of the Western Union exchange rate your dollar to INR guide is rooted in ongoing financial realities and Western Union's extensive global footprint. Key details include:

- Real-time Rates: Exchange rates are fluid and change minute-by-minute throughout the global trading day. Western Union provides real-time rates on its website and app.

- Global Network: Western Union operates in over 200 countries and territories, with hundreds of thousands of agent locations worldwide, including a vast network across India.

- Service Availability: Services are available 24/7 through Western Union's digital channels, while agent locations operate during business hours.

- Regulatory Compliance: All transfers are subject to financial regulations in both the U.S. and India, ensuring security and legitimacy.

The "guide" aspect emphasizes navigating these dynamic elements effectively for individual users, providing a timeless resource for a constantly evolving financial landscape.

How To Get Involved or Access the Western Union Exchange Rate Your Dollar to INR Guide

Accessing and utilizing the Western Union exchange rate your dollar to INR guide involves understanding how to use Western Union's services for remittances. This typically follows a structured process:

- Visit the Western Union Website or App: Begin by navigating to Western Unions official digital platforms to check current exchange rates and initiate transfers.

- Create an Account: New users will need to register, providing necessary identification for verification.

- Enter Transfer Details: Specify the amount in USD intended for transfer, the destination country (India), and the desired payout method (e.g., bank account, cash pickup).

- Review Exchange Rate and Fees: The platform will display the current USD to INR exchange rate and any associated transfer fees before final confirmation. This step is critical for comparing options.

- Provide Recipient Information: Accurately input the recipient's name, address, and bank details (if sending to a bank account).

- Fund the Transfer: Choose a payment method, such as a bank account, debit card, or credit card, to fund the transfer.

- Track the Transfer: A tracking number (MTCN) is provided to monitor the status of the transfer until funds are successfully delivered.

What To Expect

- Dynamic Rates: The USD to INR exchange rate provided by Western Union can fluctuate, impacting the final INR amount received.

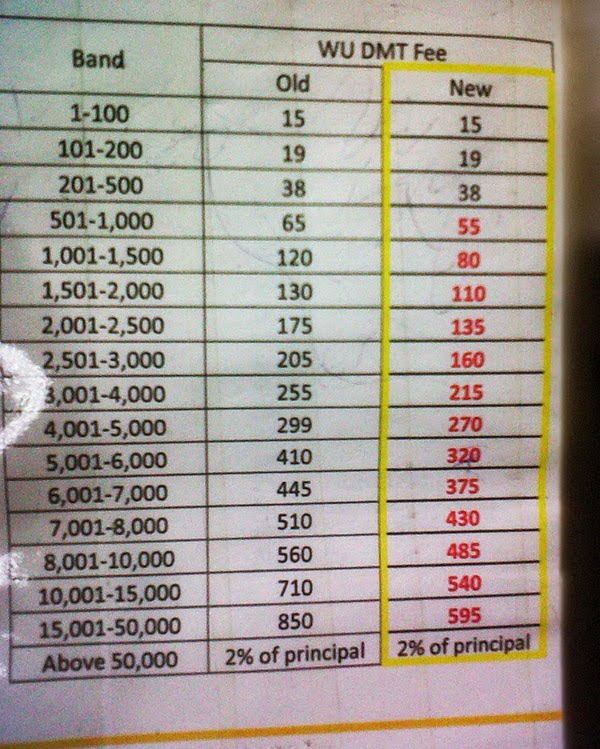

- Variable Fees: Transfer fees can depend on the amount sent, the payment method, and the payout option chosen.

- Multiple Payout Options: Recipients in India can typically receive funds via bank account deposits, mobile wallets, or cash pickup at agent locations.

- Transparency in Pricing: Western Union aims to provide clear information on exchange rates and fees upfront, though comparing with other services is always recommended.

- Security Measures: Robust security protocols are in place to protect transactions and personal information.

The Broader Impact of the Western Union Exchange Rate Your Dollar to INR Guide

The effective management of the Western Union exchange rate for USD to INR transfers has a significant impact beyond individual transactions. It influences the economic well-being of countless families in India, providing crucial support for education, healthcare, and daily expenses. For senders in the U.S., understanding this guide means exercising greater control over their financial contributions and maximizing the value sent home. The aggregate effect of competitive exchange rates and efficient transfer services contributes to the substantial flow of remittances, which serves as a vital external financing source for India's economy. These financial pipelines are critical for economic stability and growth in recipient nations.

For many families, remittances are the lifeline connecting opportunity abroad with needs at home. A clear guide to exchange rates and transfer services empowers senders to ensure every dollar stretches further, directly impacting household welfare and economic resilience, states a financial analyst specializing in global remittances.

Economic or Social Insights

The U.S. to India remittance corridor is consistently one of the largest globally, highlighting the economic significance of understanding services like Western Union. According to insights often cited by publications like The World Bank and Business Insider, India's remittance inflows regularly exceed tens of billions of dollars annually, with the U.S. being a primary source country. The competitiveness of exchange rates offered by services like Western Union directly influences the purchasing power of these funds in India. Socially, the ease and transparency of these transfers reduce stress for senders and provide financial predictability for recipients, strengthening transnational family ties and supporting local communities.

Frequently Asked Questions About the Western Union Exchange Rate Your Dollar to INR Guide

- What is the Western Union exchange rate your dollar to INR guide? This guide is a comprehensive resource that helps U.S. individuals understand how Western Union converts their U.S. dollars into Indian Rupees, including details on exchange rates, fees, transfer methods, and optimizing the value of their remittances.

- Why is checking the exchange rate important when sending money to India? The exchange rate directly determines how many Indian Rupees a U.S. dollar will yield. A favorable rate means more INR for the same USD amount, maximizing the financial support sent to recipients in India.

- How can people get the best Western Union exchange rate for USD to INR? While Western Union provides competitive rates, it is advisable to check rates frequently, compare them with other providers, and consider sending larger amounts, as fees and rates can sometimes be more favorable for bigger transfers.

- Is Western Union legitimate and official for transfers to India? Yes, Western Union is a long-established and regulated financial service provider known globally for legitimate international money transfers. It operates officially in both the U.S. and India.

- What can attendees or users expect when using this guide? Users can expect to gain a clear understanding of the Western Union transfer process, the factors influencing exchange rates, the costs involved, and practical tips for ensuring their money reaches India efficiently and at the best possible value.

Conclusion

The Western Union exchange rate your dollar to INR guide stands as an indispensable resource for anyone in the U.S. looking to send money to India. Its importance lies in demystifying the complexities of international currency exchange, empowering senders to navigate transfer options with confidence and precision. By understanding the real-time rates, associated fees, and available payout methods, individuals can ensure their hard-earned dollars provide maximum benefit to their loved ones or financial commitments in India. This guide underscores the necessity of informed decision-making in the realm of global remittances.