Kenvue Stock Price Forecasts Investment Guide

Lead: Kenvue, the consumer health giant spun off from Johnson & Johnson, has quickly become a focal point for investors seeking stable growth and dividend income. Understanding Kenvue stock price forecasts and comprehensive investment guides is paramount for making informed decisions in today's dynamic market. This article delves into what investors need to know about Kenvue's market position, the significance of expert analysis, and how to utilize forecasting tools to shape an effective investment strategy.

What Is Kenvue Stock Price Forecasts Investment Guide?

A Kenvue stock price forecasts investment guide consolidates expert opinions, analytical data, and market trends to project the future performance of Kenvue's stock. These guides typically provide:

- Target Price Estimates: A projected range or specific price point analysts believe the stock will reach within a defined timeframe (e.g., 12 months).

- Rating System: Recommendations such as "Buy," "Hold," or "Sell," reflecting the analysts' outlook on the stock's potential relative to its current price.

- Fundamental Analysis: An examination of Kenvue's financials, including revenue, earnings per share, profit margins, and debt, to assess its intrinsic value.

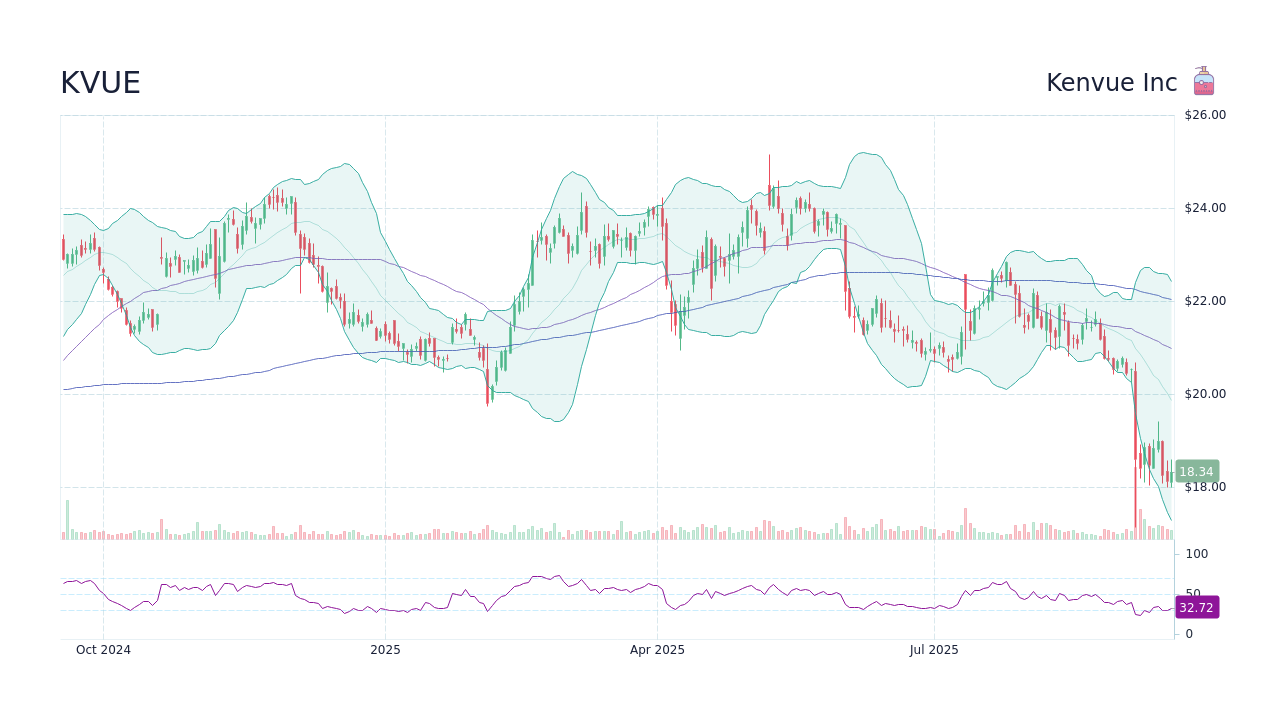

- Technical Analysis: Study of historical stock price movements and trading volumes to identify patterns and predict future price action.

- Risk Assessment: Identification of potential headwinds, market volatility, competitive pressures, and regulatory changes that could impact Kenvue's performance.

Such a guide serves as a crucial resource for both new and seasoned investors, offering a structured approach to evaluating Kenvue as a potential addition to their portfolio.

Why Kenvue Stock Price Forecasts Investment Guide Is Trending

Kenvue's emergence as an independent, publicly traded entity is a significant event in the consumer health sector. Its portfolio, which includes iconic brands like Tylenol, Listerine, and Neutrogena, generates substantial and consistent revenue. The spin-off created a pure-play consumer health company, distinguishing it from its former parent's pharmaceutical and medical device businesses. This clear focus, coupled with Kenvue's strong market share in essential product categories, has attracted considerable investor attention. The company's potential for steady dividends and defensive characteristics (resilience during economic downturns) makes its stock a subject of intense scrutiny, leading to a high demand for detailed forecasts and investment guidance.

Dates, Locations, or Key Details

Kenvue officially debuted on the New York Stock Exchange (NYSE) under the ticker symbol "KVUE" on May 4, 2023, following its initial public offering (IPO). The full separation from Johnson & Johnson was completed in August 2023. Headquartered in Skillman, New Jersey, Kenvue operates globally, serving consumers in more than 165 countries. Its extensive brand portfolio, deeply embedded in daily consumer routines, positions it as a significant player in the consumer staples sector. Investors typically look at 12-month forward forecasts when evaluating Kenvue's stock performance.

How To Get Involved or Access Kenvue Stock Price Forecasts Investment Guide

Accessing reliable Kenvue stock price forecasts and investment guides involves leveraging established financial resources:

- Financial News Outlets: Major financial news publications (e.g., The Wall Street Journal, Bloomberg, Reuters) frequently publish analyst reports and summaries.

- Brokerage Platforms: Most online brokerage accounts offer access to proprietary research, analyst ratings, and target prices for stocks like Kenvue.

- Specialized Investment Research Services: Subscription-based platforms provide in-depth reports, quantitative analysis, and detailed forecasts from independent research firms.

- Investor Relations Website: Kenvue's official investor relations website provides financial filings, earnings call transcripts, and presentations that offer insights into the company's outlook.

- Financial Advisors: Consulting with a certified financial advisor can provide personalized guidance tailored to individual investment goals and risk tolerance.

What To Expect

- Forecasts typically include a price target, often with a bull-case (optimistic) and bear-case (pessimistic) scenario.

- Expect analysis on Kenvue's competitive landscape, product innovation, and market expansion opportunities.

- Detailed guides often provide insight into dividend policy and the company's capital allocation strategies.

- Information regarding Kenvue's valuation multiples compared to industry peers in the consumer health sector.

The Broader Impact of Kenvue Stock Price Forecasts Investment Guide

Kenvue's market capitalization places it among the leading consumer health companies globally, making its stock performance a barometer for the stability and growth prospects of the broader consumer staples sector. Accurate forecasts for Kenvue can influence investor sentiment toward other defensive stocks and shape broader market trends, particularly for those seeking dividend-paying assets. Its resilience during economic downturns, driven by non-discretionary consumer purchases, means Kenvue's stock is often viewed as a safe haven, making its performance closely watched by institutional investors and retail traders alike.

Kenvue represents a compelling opportunity in consumer health, offering a robust portfolio of household names and a clear path for independent growth. Comprehensive investment guides are essential for dissecting its value proposition and understanding its long-term trajectory, observed a leading market strategist.

Economic or Social Insights

Kenvue's position in the consumer health market means its performance is generally less susceptible to cyclical economic fluctuations than other sectors. Its products, ranging from pain relief to oral care, are everyday necessities, ensuring relatively stable demand even during periods of economic uncertainty. This stability can offer investors a degree of predictability, making Kenvue an attractive option for those prioritizing consistent returns and dividends. Major financial publications like Bloomberg and The Wall Street Journal frequently cover Kenvue's financial results and analyst upgrades or downgrades, highlighting its significance within the U.S. and global economies.

Frequently Asked Questions About Kenvue Stock Price Forecasts Investment Guide

- What is Kenvue stock price forecasts investment guide? It is a comprehensive document or analysis that provides projections for Kenvue's stock price, coupled with detailed fundamental and technical analysis to help investors make informed decisions.

- Why is Kenvue stock price forecasts investment guide popular? Its popularity stems from Kenvue's recent spin-off, its strong portfolio of established consumer health brands, and its potential as a stable, dividend-paying investment in the consumer staples sector.

- How can people participate or experience it? Investors can access these guides through financial news websites, brokerage firm research portals, specialized investment platforms, or by consulting with a financial advisor.

- Is it legitimate or official? While the term "investment guide" broadly refers to various analyses, legitimate guides are typically produced by reputable financial institutions, independent research firms, or certified financial analysts, based on rigorous methodologies.

- What can attendees or users expect? Users can expect data-driven insights, price targets, buy/hold/sell recommendations, and a detailed breakdown of the factors influencing Kenvue's stock performance, assisting in strategic portfolio planning.

Conclusion

For investors navigating the complexities of the stock market, a well-researched Kenvue stock price forecasts investment guide is an indispensable tool. It distills complex financial data into actionable insights, offering a clearer picture of Kenvue's potential and associated risks. As a newly independent company with a formidable market presence, Kenvue continues to be a subject of keen interest, and understanding the expert projections surrounding its stock is crucial for making judicious investment choices.